Loans and Bonds

As of February 18, 2026

This table can be scrolled left and right.

| Loan Date | Lender | Loan Amount (JPY M) |

Interest Rate |

Redemption Date | Maturity |

|---|---|---|---|---|---|

| April 27, 2018 | SMBC Mizuho Trust & Banking Aozora Bank SBI Shinsei Bank Resona Bank |

3,954 | 0.99000%¹ |

April 30, 2026 | 8.0 years |

| October 31, 2018 | SMBC | 1,000 | 0.96250%¹ |

April 30, 2026 | 7.5 years |

| October 31, 2018 | Mizuho Bank | 400 | 1M JPY TIBOR+0.65% (floating) |

April 30, 2026 | 7.5 years |

| October 31, 2018 | SBI Shinsei Bank | 200 | 1M JPY TIBOR+0.65% (floating) |

April 30, 2026 | 7.5 years |

| November 30, 2018 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank |

2,866 | 0.97500%¹ |

September 30, 2026 | 7.8 years |

| December 21, 2018 | SMBC Aozora Bank |

1,400 | 0.90750%¹ |

September 30, 2026 | 7.8 years |

| December 28, 2018 | SMBC Mizuho Bank SBI Shinsei Bank MUFG Bank Development Bank of Japan |

1,600 | 0.85000%¹ |

April 30, 2026 | 7.3 years |

| April. 26, 2019 | SMBC | 1,000 | 0.86700%¹ |

September 25, 2026 | 7.4 years |

| April. 26, 2019 | Resona Bank | 1,000 | 0.86700%¹ |

September 25, 2026 | 7.4 years |

| April. 26, 2019 | The Bank of Fukuoka | 1,000 | 0.86700%¹ |

September 25, 2026 | 7.4 years |

| July 31, 2019 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank Resona Bank ORIX Bank |

4,955 | 0.82200%¹ |

March 25, 2027 | 7.7 years |

| September 30, 2019 | SMBC | 692 | 0.72600%¹ |

March 25, 2026 | 6.5 years |

| November 29, 2019 | SMBC Mizuho Bank SBI Shinsei Bank MUFG Bank |

2,472 | 0.84425%¹ |

September 25, 2027 | 7.8 years |

| December 16, 2019 | SMBC Mizuho Bank SBI Shinsei Bank MUFG Bank Aozora Bank Resona Bank |

5,384 | 0.87600%¹ |

September 25, 2027 | 7.8 years |

| March 31, 2020 | The Kagawa Bank | 955 | 3M JPY TIBOR+0.59% (floating) |

March 25, 2027 | 7.0 years |

| May 29, 2020 | SMBC SBI Shinsei Bank Mizuho Bank MUFG Bank |

2,000 | 0.74000%¹ |

March 25, 2027 | 6.8 years |

| August 31, 2020 | Aozora Bank | 2,127 | 0.82800%¹ |

August 25, 2028 | 8.0 years |

| August 31, 2020 | SBI Shinsei Bank | 998 | 0.72200%¹ |

March 25, 2027 | 6.6 years |

| August 31, 2020 | SBI Shinsei Bank | 1,000 | 0.82800%¹ |

August 25, 2028 | 8.0 years |

| August 31, 2020 | Mizuho Bank | 400 | 0.82800%¹ |

August 25, 2028 | 8.0 years |

| December 10, 2020 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank |

2,670 | 0.78775%¹ |

November 25, 2028 | 8.0 years |

| December 18, 2020 | SMBC | 800 | 0.80200%¹ |

November 25, 2028 | 7.9 years |

| December 18, 2020 | Mizuho Bank | 700 | 0.80200%¹ |

November 25, 2028 | 7.9 years |

| December 18, 2020 | The Bank of Yokohama | 500 | 0.80200%¹ |

November 25, 2028 | 7.9 years |

| March 31, 2021 | SMBC Mizuho Bank Aozora Bank Resona Bank Mizuho Trust & Banking |

3,097 | 0.87600%¹ |

March 25, 2029 | 8.0 years |

| May 7, 2021 | SMBC Mizuho Bank Resona Bank Aozora Bank SBI Shinsei Bank The Bank of Yokohama |

1,442 | 0.73345%¹ |

March 25, 2028 | 6.9 years |

| May 7, 2021 | SMBC Mizuho Bank Resona Bank SBI Shinsei Bank Aozora Bank |

3,747 | 0.81985%¹ |

May 25, 2029 | 8.1 years |

| September 30, 2021 | Development Bank of Japan | 500 | 0.76433% | September 25, 2028 | 7.0 years |

| November 8, 2021 | SMBC Mizuho Bank MUFG Bank The Bank of Fukuoka The Bank of Yokohama |

2,546 | 0.61250%¹ |

September 25, 2026 | 4.9 years |

| November 8, 2021 | SMBC Mizuho Bank Resona Bank SBI Shinsei Bank Aozora Bank The Bank of Yokohama |

1,676 | 0.72020%¹ |

March 25, 2028 | 6.4 years |

| November 8, 2021 | SMBC Mizuho Bank Resona Bank SBI Shinsei Bank Aozora Bank |

4,899 | 0.83300%¹ |

November 25, 2029 | 8.1 years |

| January 31, 2022 | Development Bank of Japan | 500 | 0.86000% | January 25, 2029 | 7.0 years |

| May 31, 2022 | SMBC Mizuho Bank MUFG Bank The Bank of Fukuoka Nishi-Nippon City Bank | 2,589 | 0.71770%¹ |

May 25, 2027 | 5.0 years |

| May 31, 2022 | SMBC Mizuho Bank Resona Bank SBI Shinsei Bank Aozora Bank Nishi-Nippon City Bank | 1,564 | 0.81630%¹ |

May 25, 2025 | 6.0 years |

| May 31, 2022 | SMBC Mizuho Bank Resona Bank SBI Shinsei Bank Aozora Bank Nishi-Nippon City Bank | 5,476 | 1.01930%¹ |

May 27, 2030 | 8.0 years |

| June 20, 2022 | SMBC | 950 | 1.10760%¹ |

May 25, 2029 | 6.9 years |

| June 20, 2022 | Mizuho Bank | 950 | 1.10760%¹ |

May 25, 2029 | 6.9 years |

| November 30, 2022 | SMBC Mizuho Bank SBI Shinsei Bank MUFG Bank Resona Bank The Bank of Fukuoka Nishi-Nippon City Bank | 4,641 | 0.95800%¹ |

November 25, 2027 | 5.0 years |

| November 30, 2022 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank | 3,278 | 1.03600%¹ |

August 25, 2028 | 5.7 years |

| November 30, 2022 | SMBC Mizuho Bank Aozora Bank Resona Bank | 1,700 | 1.60900%¹ |

September 25, 2032 | 9.8 years |

| January 27, 2023 | SMBC | 700 | 1.72300%¹ |

January 25, 2032 | 9.0 years |

| January 27, 2023 | Mizuho Bank | 600 | 1.72300%¹ |

January 25, 2032 | 9.0 years |

| January 27, 2023 | The Bank of Fukuoka | 200 | 1.40500%¹ |

October 25, 2029 | 6.7 years |

| January 27, 2023 | Nishi-Nippon City Bank | 300 | 1.40500%¹ |

October 25, 2029 | 6.7 years |

| May 10, 2023 | Development Bank of Japan | 2,000 | 1.10883% | September 25, 2029 | 6.3 years |

| September 25, 2023 | SMBC Mizuho Bank MUFG Bank SBI Shinsei Bank | 1,004 | 1.16000%¹ |

April 25, 2028 | 4.6 years |

| September 25, 2023 | SMBC Mizuho Bank SBI Shinsei Bank | 2,043 | 1.64400%¹ |

July 25, 2031 | 7.8 years |

| October 31, 2023 | SMBC Mizuho Bank MUFG Bank SBI Shinsei Bank The Bank of Fukuoka Resona Bank | 813 | 1.20200%¹ |

May 25, 2028 | 4.6 years |

| October 31, 2023 | SMBC Mizuho Bank The Bank of Fukuoka Resona Bank Kansai Mirai Bank | 787 | 1.77300%¹ |

October 25, 2031 | 8.0 years |

| October 31, 2023 | SMBC | 1,000 | 1.77200%¹ |

October 25, 2031 | 8.0 years |

| February 29, 2024 | SMBC | 500 | 1.52200%¹ |

October 25, 2031 | 7.7 years |

| February 29, 2024 | Mizuho Bank | 400 | 1.52200%¹ |

October 25, 2031 | 7.7 years |

| April 30, 2024 | SMBC Mizuho Bank MUFG Bank SBI Shinsei Bank The Bank of Fukuoka Nishi-Nippon City Bank | 635 | 1.28420%¹ |

March 25, 2029 | 4.9 years |

| April 30, 2024 | SMBC Mizuho Bank SBI Shinsei Bank The Bank of Fukuoka Nishi-Nippon City Bank The Kagawa Bank |

1,365 | 1.64200%¹ |

October 25, 2031 | 7.5 years |

| May 30, 2024 | SMBC | 3,300 | 1.65300%¹ |

April 25, 2031 | 6.9 years |

| May 30, 2024 | Mizuho Bank | 2,000 | 1.65300%¹ |

April 25, 2031 | 6.9 years |

| May 30, 2024 | Aozora Bank | 1,000 | 1.65300%¹ |

April 25, 2031 | 6.9 years |

| May 30, 2024 | SBI Shinsei Bank | 1,000 | 1.65300%¹ |

April 25, 2031 | 6.9 years |

| May 30, 2024 | MUFG Bank | 900 | 1.31656% |

April 25, 2029 | 4.9 years |

| May 30, 2024 | SBI Shinsei Bank | 300 | 1.38700%¹ |

April 25, 2029 | 4.9 years |

| September 25, 2024 | SMBC Mizuho Bank MUFG Bank The Bank of Fukuoka |

2,132 | 1.15381% |

October 25, 2028 | 4.1 years |

| September 25, 2024 | SMBC Mizuho Bank The Bank of Fukuoka The Bank of Yokohama Mizuho Trust & Banking |

2,060 | 1M JPY TIBOR+0.60% (floating) |

April 25, 2031 | 6.6 years |

| November 11, 2024 | SMBC Mizuho Bank MUFG Bank SBI Shinsei Bank Resona Bank |

812 | 1.35790% |

October 25, 2029 | 5.0 years |

| November 11, 2024 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank Resona Bank The Kagawa Bank | 2,134 | 1M JPY TIBOR+0.65% (floating) |

April 25, 2032 | 7.5 years |

| November 11, 2024 | SMBC | 1,100 | 1M JPY TIBOR+0.59% (floating) |

April 25, 2031 | 6.5 years |

| November 11, 2024 | Mizuho Bank | 1,000 | 1M JPY TIBOR+0.59% (floating) |

April 25, 2031 | 6.5 years |

| November 11, 2024 | SBI Shinsei Bank | 900 | 1M JPY TIBOR+0.56% (floating) |

October 25, 2030 | 6.0 years |

| November 11, 2024 | Resona Bank | 400 | 1M JPY TIBOR+0.56% (floating) |

October 25, 2030 | 6.0 years |

| March 25, 2025 | SMBC | 1,000 | 1M JPY TIBOR+0.50% (floating) |

March 25, 2030 | 5.0 years |

| September 25, 2025 | SMBC Mizuho Bank MUFG Bank Aozora Bank Resona Bank |

1,235 | 2.01036% |

March 25, 2030 | 4.5 years |

| September 25, 2025 | SMBC Mizuho Bank SBI Shinsei Bank Aozora Bank Resona Bank The Kagawa Bank | 1,879 | 1M JPY TIBOR+0.57% (floating) |

October 25, 2031 | 6.1 years |

| October 24, 2025 | SMBC | 881 | 3M JPY TIBOR+0.62% (floating) |

October 25, 2032 | 7.0 years |

| October 31, 2025 | SMBC Aozora Bank MUFG Bank SBI Shinsei Bank Mizuho Bank |

734 | 2.03631% |

March 25, 2030 | 4.4 years |

| October 31, 2025 | SMBC Mizuho Bank Resona Bank MUFG Bank | 1,646 | 1M JPY TIBOR+0.59% (floating) |

April 25, 2032 | 6.5 years |

| November 27, 2025 | Mizuho Bank | 1,000 | 1M JPY TIBOR+0.58% (floating) |

April 25, 2032 | 6.4 years |

| February 18, 2026 | SMBC | 1,000 | 1M JPY TIBOR+0.59% (floating) |

July 25, 2032 | 6.4 years |

| February 18, 2026 | MUFG Bank | 1,000 | 1M JPY TIBOR+0.59% (floating) |

July 25, 2032 | 6.4 years |

| Total | 121,388 | ||||

Fixed via interest rate swap

| Issue Date | Name | Issue Amount (JPY million) |

Interest Rate | Redemption Date | Maturity |

|---|---|---|---|---|---|

| September 22, 2017 | First Unsecured Investment Corporation Bonds |

1,200 | 0.90000% | September 22, 2027 | 10.0 years |

| April 26, 2018 | Second Unsecured Investment Corporation Bonds |

1,000 | 0.90000% | April 26, 2028 | 10.0 years |

| July 26, 2019 | Fourth Unsecured Investment Corporation Bonds |

1,200 | 0.89000% | July 26, 2029 | 10.0 years |

| May 6, 2021 | Sixth Unsecured Investment Corporation Bonds |

1,500 | 0.85000% | May 2, 2031 | 10.0 years |

| November 20, 2023 | First Callable Unsecured Investment Corporation Bonds |

350 | 1.00000% | November 20, 2033 | 10.0 years |

| Total | 5,250 | ||||

| Total Interest-Bearing Liabilities | 126,638 | ||||

(Note) The average interest rate of interest-bearing liabilities is 1.05018% as of October 31, 2025.

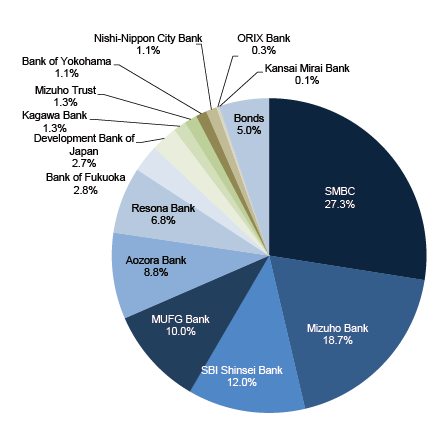

Lender Distribution

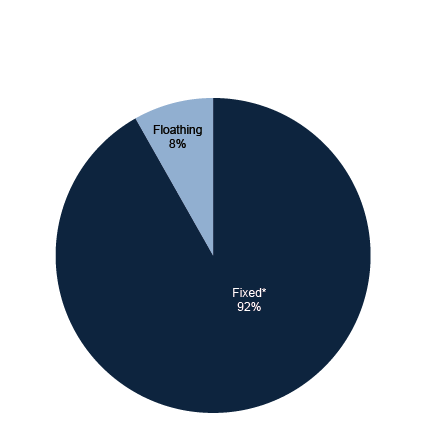

Distribution of Fixed vs. Floating Rate

* Includes fixed via interest rate swaps

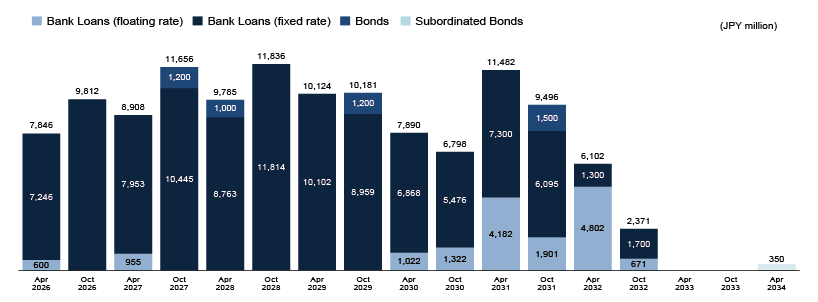

Distribution of Loan and Bond Maturities

Note: The distribution of loan repayment dates is calculated based on the total loans outstanding as of the maturity date of each loan.